STOP COMPETING

ON RATES.

START LEADING

WITH STRATEGY.

$1,499 -

Everything

Included

*minimum 2 years experience

Life-Changing Education

Certified Liability Advisor™

Finally, an enormous benefit of earning your CLA™ - you'll become eligible to be a member of the National Institute of Financial Education - www.niofe.org, a 501(c)3 non-profit and Google Grant Recipient. NIFE connects consumers with liability advisors across the United States. NIFE supports corporations, local businesses, high schools, colleges, and other non-profits

Become a CLA

Unlock a new level of influence, referrals, and credibility.

Certified Liability Advisor™

The CLA™ designation equips mortgage professionals to lead with advice, create lifelong client value, and stand out in a crowded market to increase your income.

"I was getting stagnant in my business and feeling down about my future. Borrow Smart University provided a detailed roadmap to a whole different way of thinking about what I do, and that lead to new referrals from financial advisors which I'd never called on before."

- a recent CLA Graduate

You’re a great loan officer, but you are tired of being seen as just another lender. Traditional mortgage training didn’t teach you how to stand out. Clients don’t always follow your advice. Referrals are more difficult to find. Tired of chasing leads? Learn how top loan officers earn consistent referrals from financial advisors.

Meet: Todd, the Certified Liability Advisor™ Designation (and our amazing community)

Borrow Smart University is the step-by-step plan for mortgage professionals ready to level up. If you are looking for more referrals, this is the solution for you.

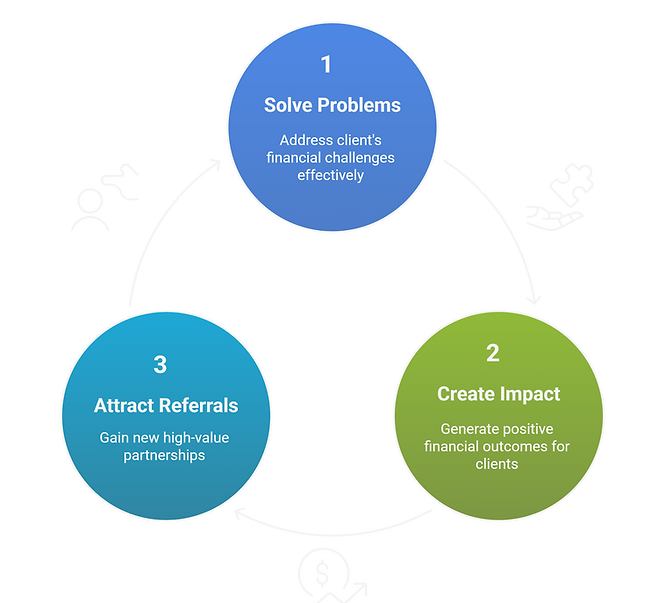

The Cycle of Financial Impact

.png)

Expectations

What can you expect?

What you can avoid?

We 100% guarantee that you will not be the same person that begins these classes. If you complete the entire course and don't believe you have truly discovered an edge that differentiates you from your competition, we'll refund your tuition. Make your NMLS rock!

96%

+32

+80

100%

Completion Rate

Unique

Classes

New

Ideas

An enormous benefit of earning your CLA™ - you'll become eligible to be a faculty member of the National Institute of Financial Education - www.niofe.org, a 501(c)3 non-profit and Google Grant Recipient. NIFE connects consumers with liability advisors across the United States. NIFE supports corporations, local businesses, high schools, colleges, and other non-profits. Many designations accept CLA for their education requirements, licensure training, and ongoing webinar certifications.

Sample Content

Graduate Testimonials

AUDIO TESTIMONIALS

RON DOERKSON

DEVON FRANCHINO

JACK MORGAN

LIVE COURSE GRADUATES

Chris Schwab:

“This was a 10 out of 10! The BSU strategies and training are part of a conversation that I cannot imagine many lenders are having with their clients and partners.”

“This training has already helped me win business easier by immediately having different conversations with financial advisors that puts us in a position of power. With the help of education courses, I am now equipped with the knowledge and skills to navigate complex financial conversations and provide valuable insights to my clients.”

“Imagine the best Tuesday Mastermind session at Macadam…now multiply that by 100.”

“The CLA is a deep dive into advanced strategies and conversations that give us the opportunity to change people’s lives.”

“Having the ability to illustrate for a client exactly why putting an extra $40,000 down on their new home may not be the most fiscally responsible decision and showing the numbers that support your opinion gives you credibility that the Rocket Mortgage types will never have. It’s an opportunity to earn trust from your clients and partners that you really are looking out for their financial well-being.”

“It would actually be harder NOT to 10x my investment of time and money. As long as you actually use the tools we were given, it’s a no brainer!”

Dan Summerfeldt:

"Definitely a 10 out of 10. Having been an MLO and a Registered Representative (Financial Consultant) in previous careers, the information in the Borrower Smart University coursework expanded my knowledge and gave me a deeper understanding of how to really help my clients be fully informed as they make decisions on how to move forward toward their financial futures."

"My biggest take-aways were the 7 Concepts & 7 Steps, and how to set myself apart from other lenders."

"I've already applied the 7 steps (to help a client decide to apply). When I use this more often, I expect my conversion rate to increase."

"This training will definitely win me more business from clients and referral partners once I have the opportunity to meet with them. Developing my Audio Logo will help me build more intrigue for prospective partners to invest the time to meet with me and learn our powerful process."

"The more I use it what I learned in Borrow Smart University, the more value I see in it. Prior to taking the course, I'd have balked at the price. After taking it, I see the value..."

"I'd be stunned if I didn't 20x my return on investment."

Marc Powarczuk:

“Absolutely a 10 out of 10. This knowledge will definitely have a positive impact on my business moving forward.”

“My absolute biggest take-aways were 1: learning the 7-steps to Borrowing Smart and understanding how to apply them to my business presentations to win more business, and 2: Understanding EPR™ along with how to help my clients identify and avoid the hidden costs of a transaction.”

“The number one thing I will be applying immediately to my business is the 7-step borrow smart conversation. This entirely unique approach will absolutely help me add more referral partners, and not just Realtors anymore, but especially financial advisors and CPA’s.”

“Any mortgage loan officer who wants a better approach to adding new business referral partners absolutely must take this course! The 7 steps and the Borrow Smart tools provide a wealth of new knowledge that gives me something fresh and different that nobody else out there is doing to win business.”