top of page

the Borrow Smart BLOG

The Borrow Smart Chronicles

Search

Returns Over Time (aka - 'stonks' go up)

This chart had a profound impact on me when I was first starting out as a young loan officer -as I began calling on financial advisors. ...

2 min read

Tale of Two Tellers - the House - vs - Home

What does this have to do with the Tale of Two Tellers? Remember when I say there this the financial decision, which is logical, and the...

2 min read

Tale of Two Tellers - Part VI

We began with a simple example. You walk into a bank, you give money to one teller and you borrow money from the other teller. This is...

3 min read

Tale of Two Tellers - Part V

Do things change when you buy a house? It depends. While you wouldn't go to the teller for a mortgage, you are still ultimately...

3 min read

Tale of Two Tellers - Part IV

We agreed you aren't spending, and that decision creates options! The options are to save, or repay If we look at this simple decision to...

2 min read

Tale of Two Tellers - Part III

We have a decision to make - one you face every single day - whether you realize it or not. If you have more money than month, and you...

2 min read

The Tale of Two Tellers - Part II

Building on the last post - we shared that over a lifetime relationship of a client - their contributing $80,000 in (checking, savings,...

2 min read

The Tale of Two Tellers - Part I

We'll do a series of posts talking about a concept I created in 2007 to help consumers understand the real cost of their money - EPR...

2 min read

Saving Early and Being Consistent => Wealth

There are many simple things that are easy to remember that can help you teach others about powerful financial concepts. We've shared...

1 min read

Why Rate Discussions Create Tension

In my prior post, we talked about dynamics around interest rate and ways (at a minimum) to move it to a discussion about payment. From...

1 min read

Why do Consumers Care About Rates?

If you were a consumer, what have you been trained to ask about? When I started in the business the interest rates were published in the...

2 min read

4 Phases of Real Estate Cycles

We move from phases where we are in a buyers market and move to a sellers market and back again. It depends on your location, property...

2 min read

Housing as a Luxury Good?

"When I started in this business, there was a broad consensus around making the American dream accessible to middle and lower income...

2 min read

Food, Clothing, Transportation, Shelter

In our series here, the 'Life Literacy' aspects of these posts will tend to focus on Esteem and Self-actualization. When it comes to our...

2 min read

Waiting for Rates to Drop? Think Different

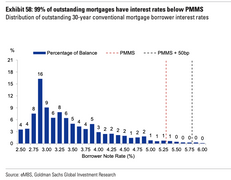

Freddie Mac reports in their Primary Mortgage Market Survey that 99% of all locked mortgage rates are below current rates, you can see...

2 min read

Are You Watching Others Change?

Am I the one who is changing, or do I find myself watching others change? Change is hard, and one of my favorite definitions of a...

2 min read

Surprise - You Might Be Equity Rich!

Equity rich is defined as having over 50% equity in the value of your house. If you own a $400,000 house and you have over $200,000 of...

2 min read

Simple Calculators to Answer Complicated Questions

At https://www.niofe.org/calculators we are adding back all our old calculators. About 9 years ago we received a $10,000 per month...

2 min read

Debt and Borrowing are Relative

Hopefully, if you are reading my blog, https://www.borrowsmartuniversity.com/single-post/information-arbitrage-the-heart-of-most-decision...

2 min read

Financial Literacy - a curiosity study...

After talking to Dave Savage about financial literacy, I realize I hadn't looked into the recent research in some time, and there is a...

1 min read

Your Income and Expectations are Programmed (good and bad)

With a network of loan officers spanning 7 states, I as the CEO was keenly focused on their success and performance. We had a pacesetter...

3 min read

Information Arbitrage - the Heart of Most Decisions

I haven't posted much here about why I write, and I haven't promoted the CLA™ course in the Blog, but I wanted to share a few thoughts...

4 min read

Is an Auto Crisis the Next Housing Crisis Jr?

I had a 2003 Suburban, loved it but we'd replaced it with a newer one. The KBB value on the car was $3,500 and that's what the dealer...

2 min read

The Renter Savings Trap - Wait to Buy?

It can be really difficult for renters to save for a down payment. If saving up to buy a house is your plan it may have some...

3 min read

(c) All Rights Reserved - KendallTodd, Inc.

bottom of page